√100以上 bond yield to maturity equation 552484-Bond yield to maturity formula

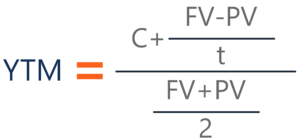

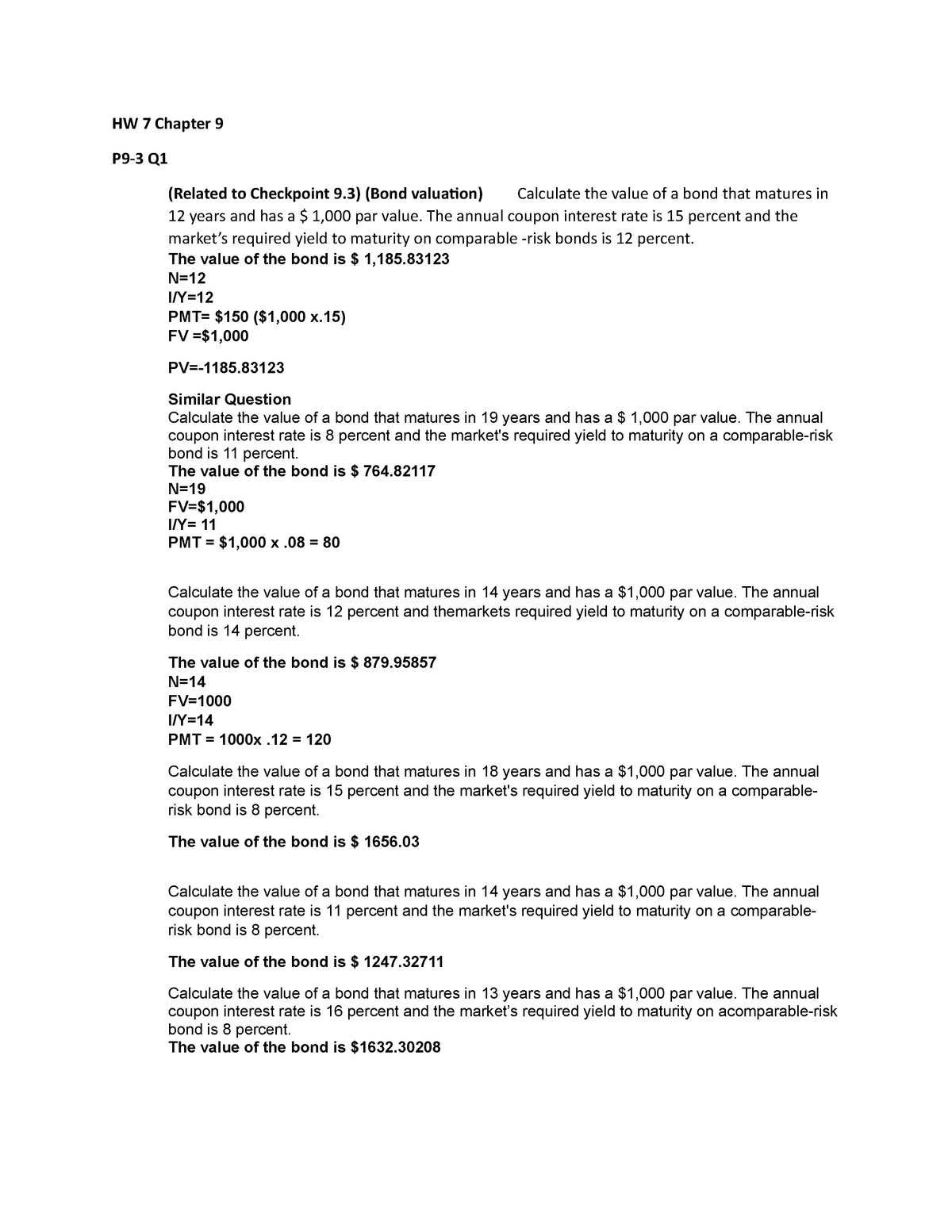

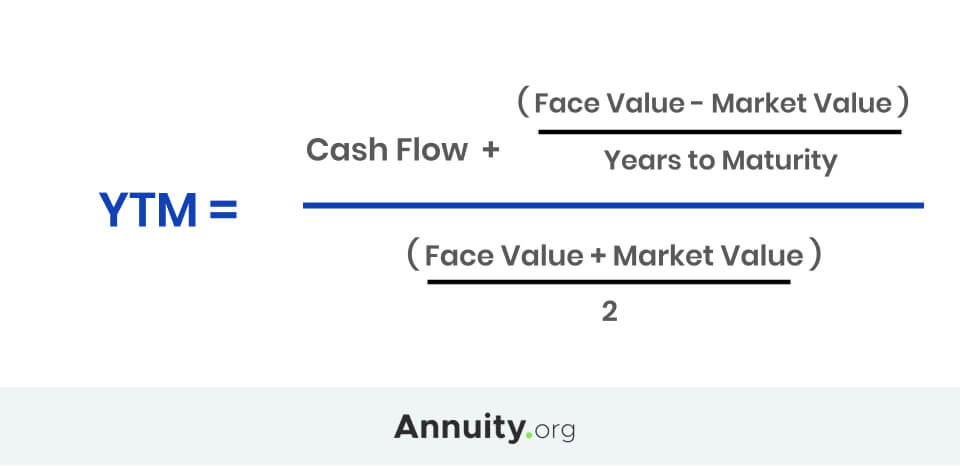

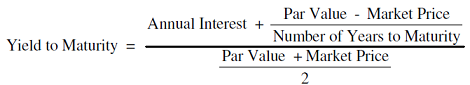

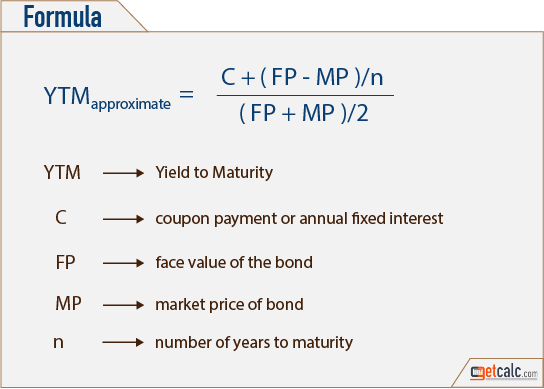

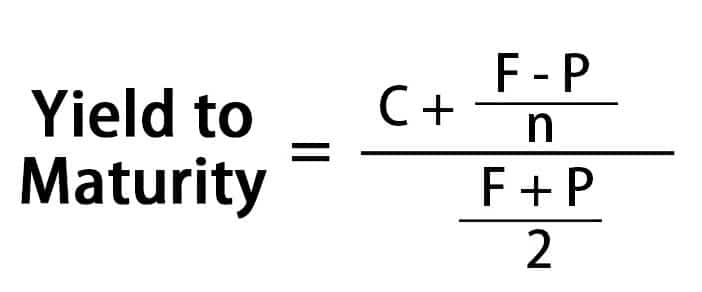

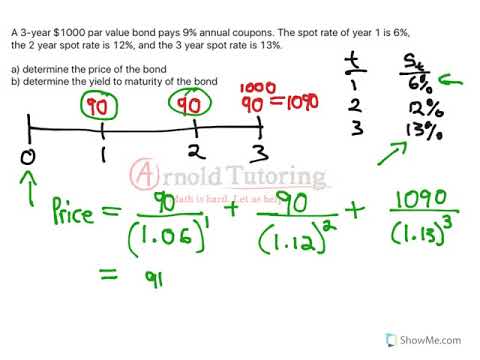

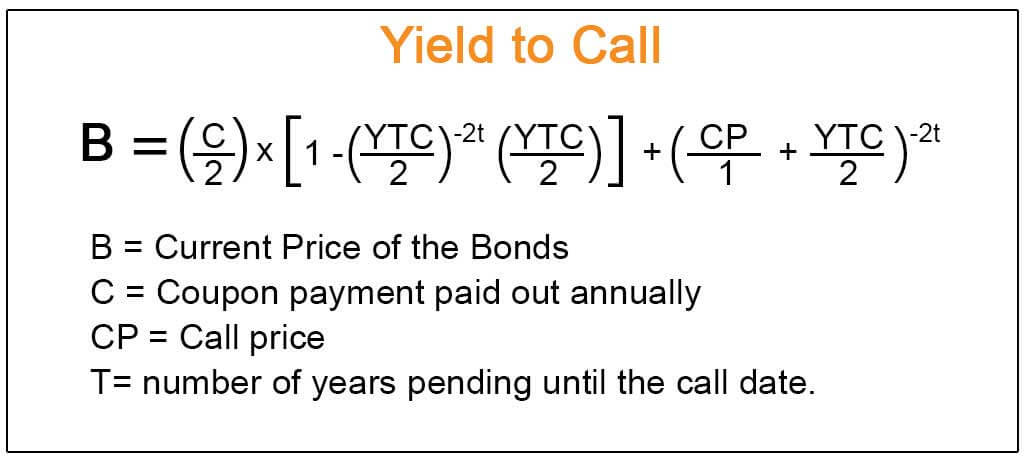

Thus, a callable bond 's true yield, called the yield to call, at any given price is usually lower than its yield to maturity As a result, investors usually consider the lower of the yield to call and the yield to maturity as the more realistic indication of the return on a callable bondN – The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%The term "yield to maturity" or YTM refers to the return expected from a bond over its entire investment period until maturity YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM

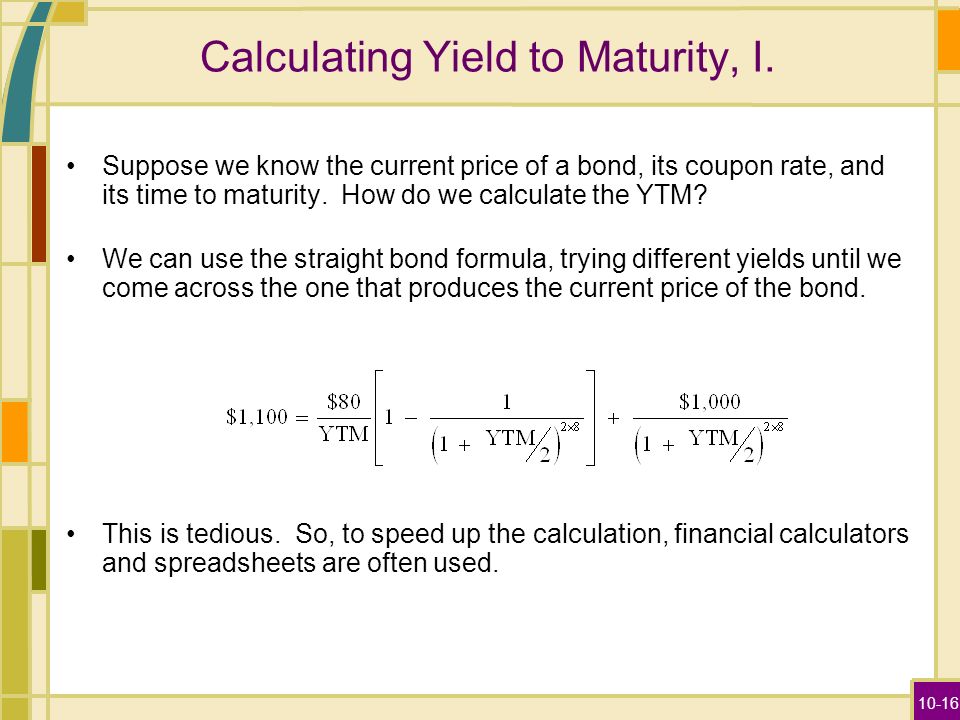

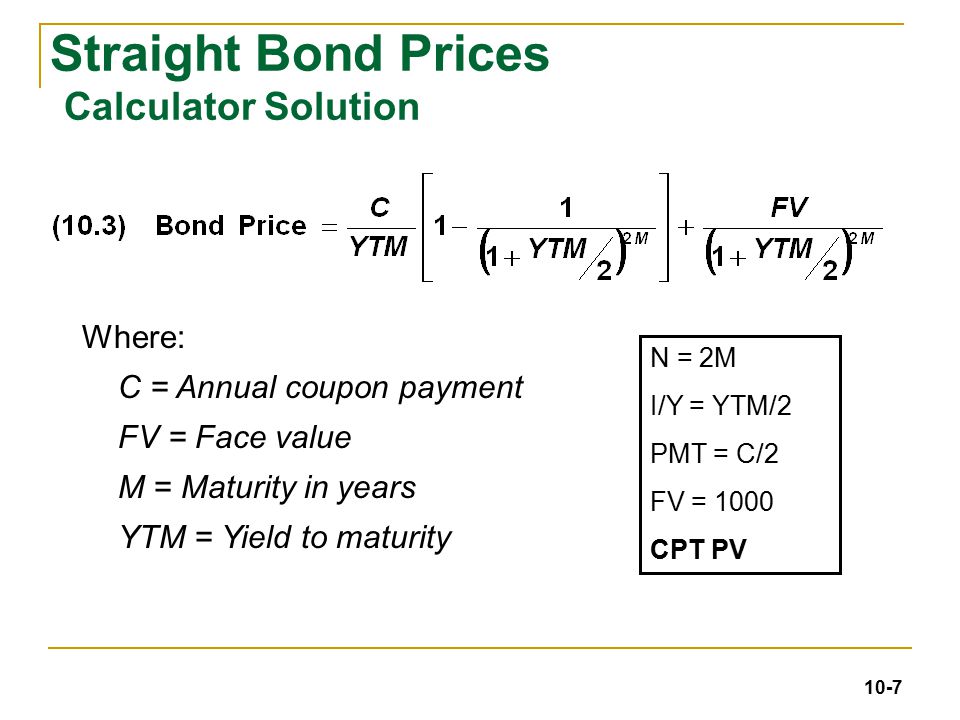

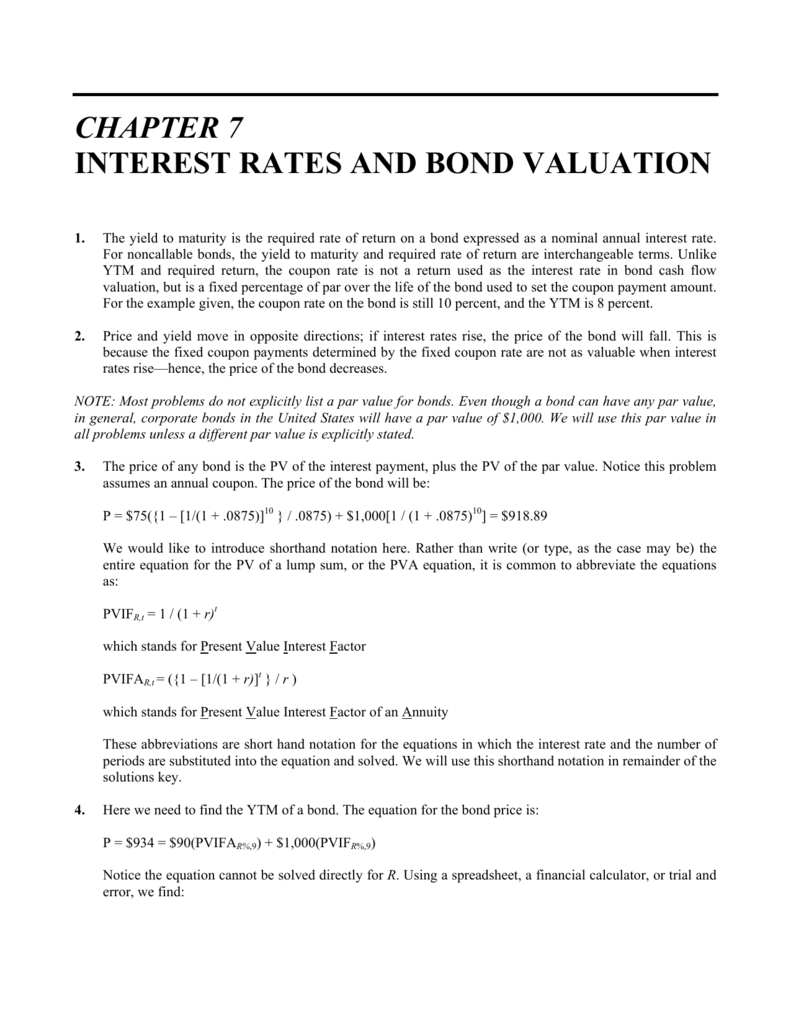

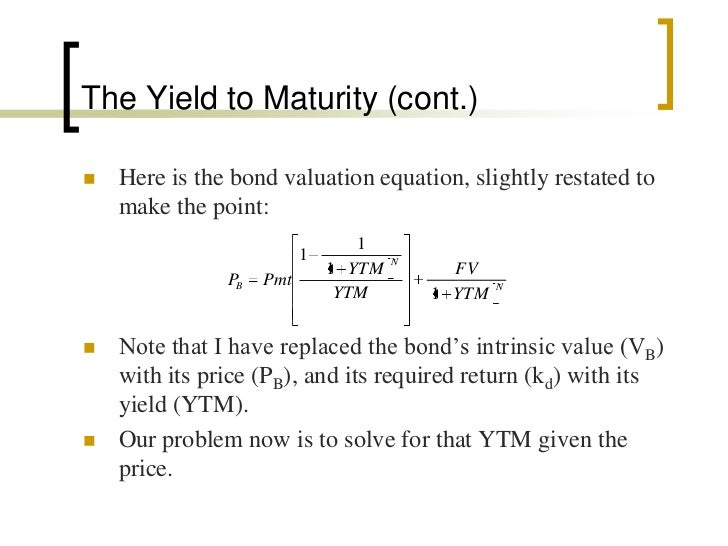

10 Bond Prices And Yields Ppt Video Online Download

Bond yield to maturity formula

Bond yield to maturity formula-However, YTM is not current yield – yield to maturity is the discount rate which would set all bond cash flows to the current price of the bond You can find more information (including an estimated formula to calculate YTM) on the yield to maturity calculator page Current Yield Formula The bond current yield formula isThey are maturing on 15 November 19 The bonds have a market value per bond of 1125 as at 15 November 12 If the tax rate is 35%, find the before tax and aftertax cost of debt Before tax cost of debt equals the yield to maturity on the bond Yield to maturity is calculated using the IRR function on a mathematical calculator or MS Excel

Solved Question 2 A 1000 Bond With A 5 Year Maturity Chegg Com

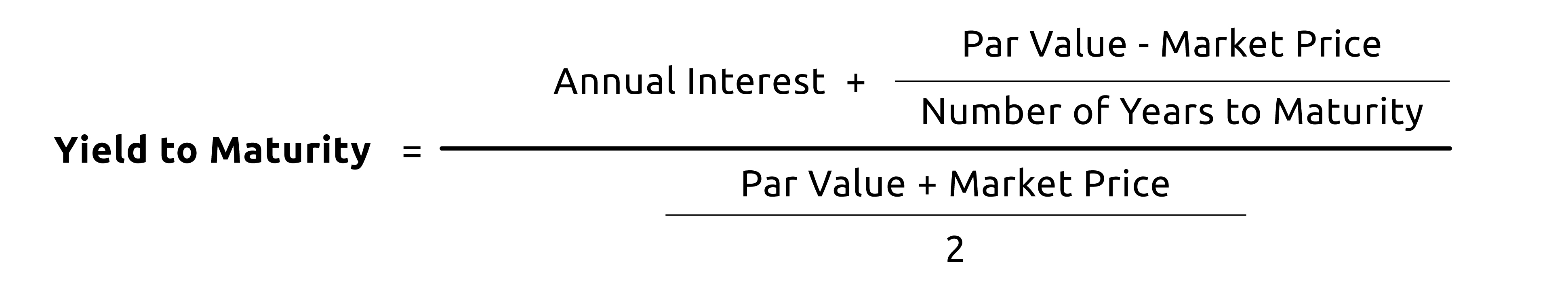

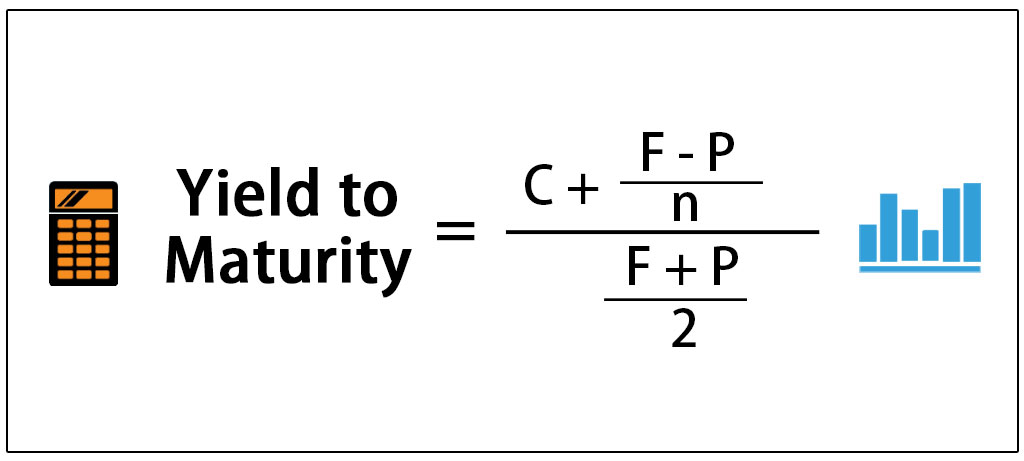

The yield to maturity (YTM), book yield or redemption yield of a bond or other fixedinterest security, such as gilts, is the (theoretical) internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity, and that all coupon and principal payments are made on scheduleC = the semiannual coupon interest;The yield to maturity equation is used to determine the total annual return that an investor will receive if an asset such as a bond is held until maturity The basics of the yield to maturity equation requires identifying the original purchase price of the asset, the rate of interest that applies, and the number of years that remain until the

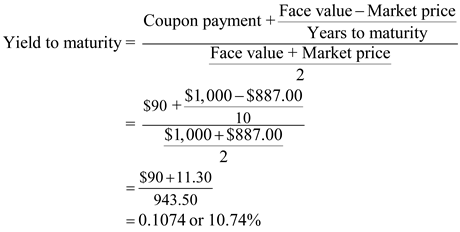

Formula to Calculate Bond Equivalent Yield (BEY) The formula is used in order to calculate the bond equivalent yield by ascertaining the difference between the bonds nominal or face value and its purchase price and these results must be divided by its price and these results must be further multiplied by 365 and then divided by the remaining days left until the maturity dateSimple yield to maturity (SYTM) is the approximate annual interest rate at which a bond yields the same return, provided the investor holds the bond until maturity and receives all of the coupon payments You cannot compute the interest rate by hand using the exact equation for yield to maturity (YTM), as that equation is too complexThis yield to maturity calculator uses information from a bond and calculates the YTM each year until the bond matures It uses the par value, market value, and coupon rate to calculate yield to maturity

If you want, you can plug this number back into equation 2, just to make sure it checks out One thing to notice is that the YTM is greater than the current yield, which in turn is greater than the coupon rate (Current yield is $70/$950 = 737%) This will always be true for a bond selling at a discount In fact, you will always have thisN = number of semiannual periods left to maturity;To apply the yield to maturity formula, we need to define the face value, bond price and years to maturity For example, if you purchased a $1,000 for $900 The interest is 8 percent, and it will mature in 12 years, we will plugin the variables

Bonds Yield To Worst Current Yield Vs Yield To Maturity

Bond Yield Calculator

Yield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input valuesYield to maturity can be mathematically derived and calculated from the formula YTM is therefore a good measurement gauge for the expected investment return of a bond When it comes to online calculation, this Yield to Maturity calculator can help you to determine the expected investment return of a bond according to the respective input valuesYield to Maturity Sarah received a $100 bond as a graduation gift The longterm bond was set to mature 15 years from the date it was issued There's still five more years remaining until it matures

Yield To Maturity Ytm Overview Formula And Importance

Yield To Maturity For Bond Valuation For Ca Final Sfm Video Classes Online Satellite Offline Youtube

The bond equivalent yield (BEY) is determined by subtracting the price (the amount originally paid) from the face value or par value (the amount paid at maturity), and then dividing the amount by the price Divide 365 (days) by the number of days before maturity Multiply that by the first part of the equation, then divide by 100 to get aThe yield to maturity (YTM), book yield or redemption yield of a bond or other fixedinterest security, such as gilts, is the (theoretical) internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity, and that all coupon and principal payments are made on scheduleYield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity It is expressed as a percentage and tells investors what their return on investment will be if they purchase the bond and hold on to it until the bond issuer pays them back

Bond Pricing Formula How To Calculate Bond Price

Bond Valuation

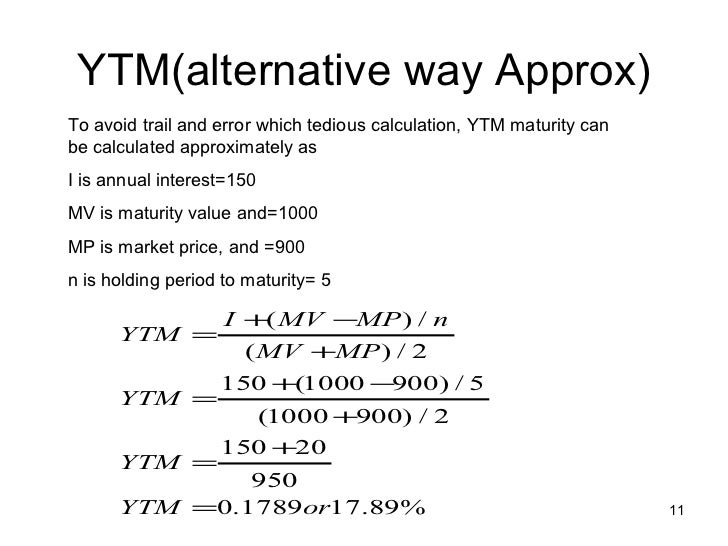

The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond for the bond is 15% and the bond will reach maturity in 7 years The formula for determining approximate YTM would look like below The approximated YTM on the bond is 1853% Importance of Yield to MaturityYield to Maturity Examples C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon paymentsThe term "yield to maturity" or YTM refers to the return expected from a bond over its entire investment period until maturity YTM is used in the calculation of bond price wherein all probable future cash flows (periodic coupon payments and par value on maturity) are discounted to present value on the basis of YTM

Bond Yield To Maturity Ytm Calculator

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

This article describes the formula syntax and usage of the YIELD function in Microsoft Excel Description Returns the yield on a security that pays periodic interest Use YIELD to calculate bond yield Syntax YIELD(settlement, maturity, rate, pr, redemption, frequency, basis)N = number of semiannual periods left to maturity;They are maturing on 15 November 19 The bonds have a market value per bond of 1125 as at 15 November 12 If the tax rate is 35%, find the before tax and aftertax cost of debt Before tax cost of debt equals the yield to maturity on the bond Yield to maturity is calculated using the IRR function on a mathematical calculator or MS Excel

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

Berk Chapter 8 Valuing Bonds

C = the semiannual coupon interest;Understanding Bond Equivalent Yield To truly understand how the bond equivalent yield formula works, it's important to know the basics of bonds in general and to grasp how bonds differ from stocksYield to maturity is an important concept for all investors to know A bond's yield to maturity isn't as simple as one might think Read this article to get an in depth perspective on what yield to maturity is, how its calculated, and why its important

How To Use The Excel Yield Function Exceljet

Valuing Bonds Boundless Finance

For bonds that do not have an annual yield clearly stated, investors can convert the stated yield into an annual yield by using the bond equivalent yield calculation BEY is useful in comparing different bonds for the purpose of analysis and investing, as it allows the analyst to make useful comparisons between bonds with annual payments andDefinition The yield to maturity (YTM) of a bond is the internal rate of return (IRR) if the bond is held until the maturity date In other words, YTM can be defined as the discount rate at which the present value of all coupon payments and face value is equal to the current market price of a bondThe yield to maturity (YTM), book yield or redemption yield of a bond or other fixedinterest security, such as gilts, is the (theoretical) internal rate of return (IRR, overall interest rate) earned by an investor who buys the bond today at the market price, assuming that the bond is held until maturity, and that all coupon and principal payments are made on schedule

Bonds Yield To Maturity Example 1 Youtube

What Is Yield To Maturity How To Calculate It Scripbox

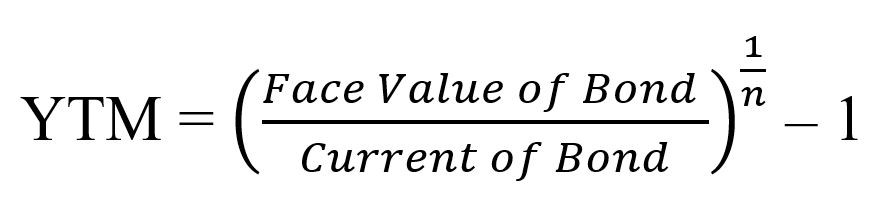

Y T M = Face Value Current Price n − 1 where n = number of years to maturity Face value = bond's maturity value or par value Current price = the bond's price today \begin{aligned} &YTMLet's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown belowP = Bond Price;

How To Calculate Yield For A Callable Bond The Motley Fool

What Is A Zero Coupon Bond

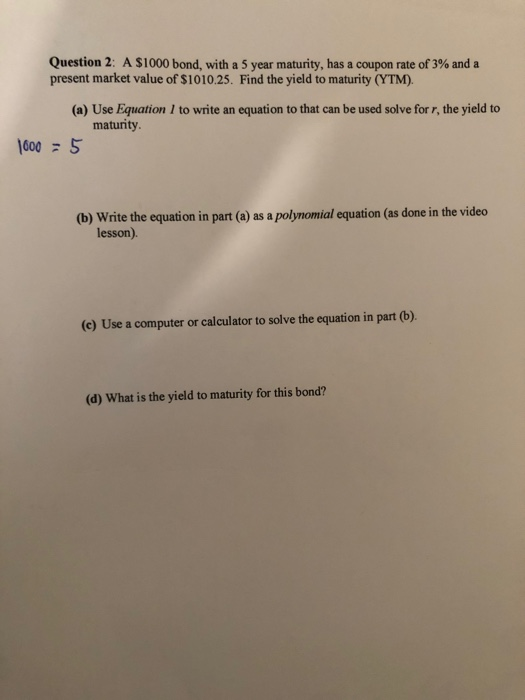

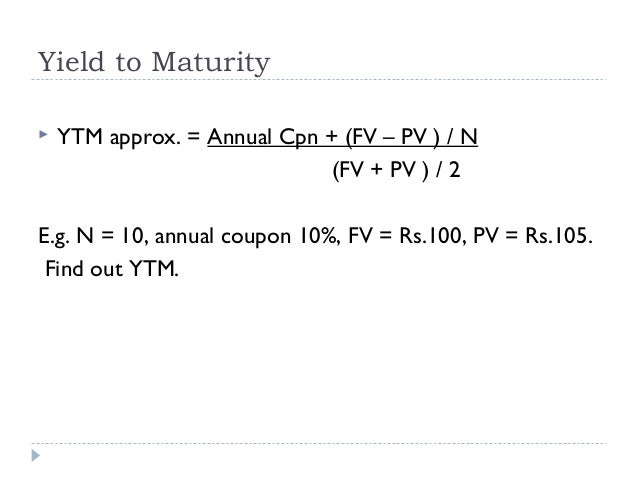

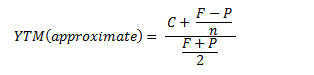

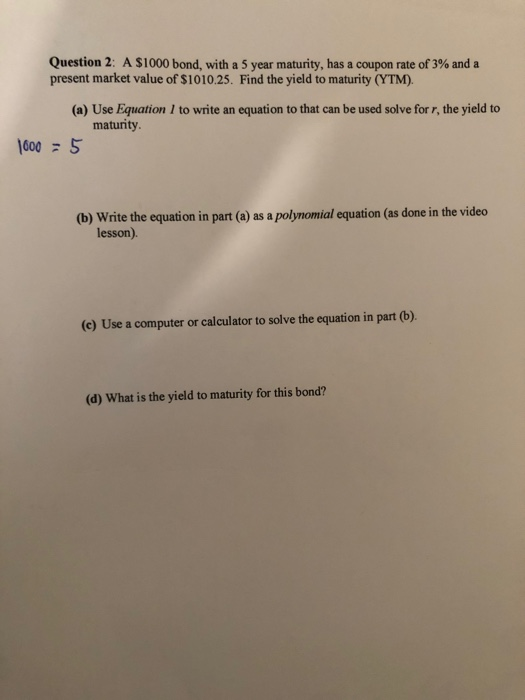

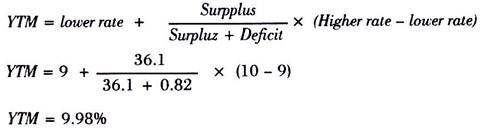

Yield to maturity in Stata The approximate yield to maturity for a coupon bond can be found using the following formula Equation 1 However, the above formula does not provide the exact value of YTM Exact value can be found by solving for rate in the following equation Equation 2The yield to maturity equation is used to determine the total annual return that an investor will receive if an asset such as a bond is held until maturity The basics of the yield to maturity equation requires identifying the original purchase price of the asset, the rate of interest that applies, and the number of years that remain until theP = Bond Price;

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

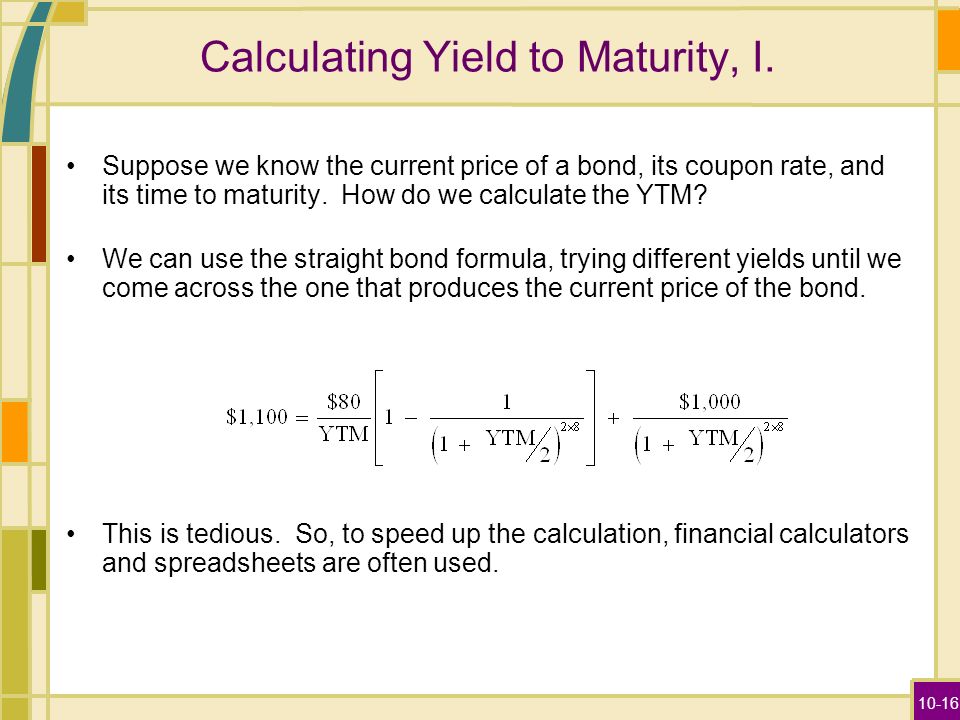

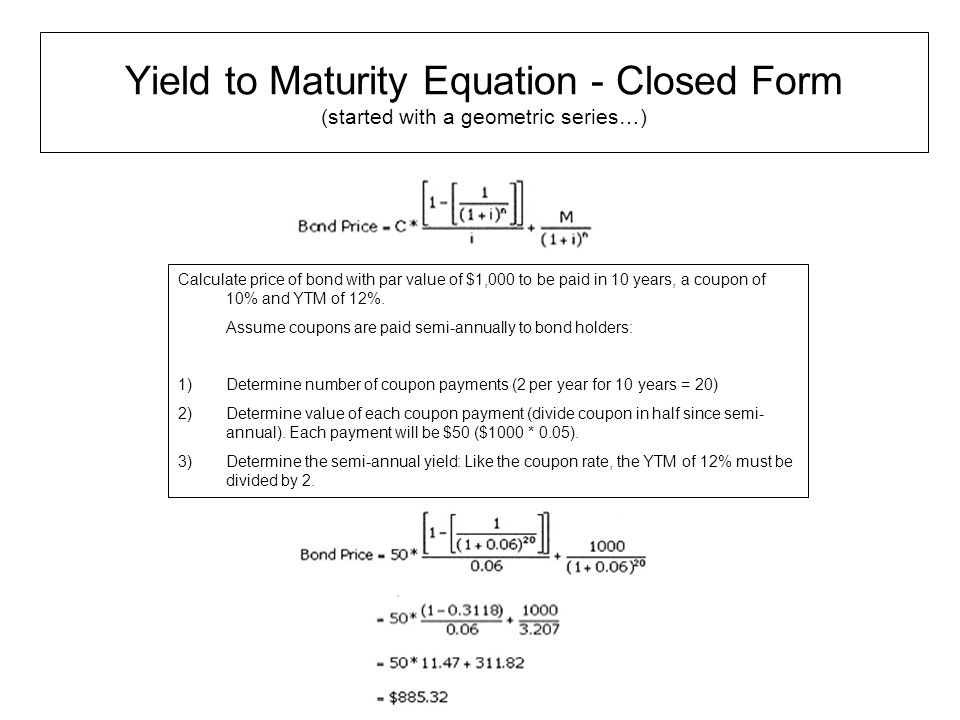

In this equation, which assumes a single annual coupon payment, YTM would be the bond's yield to maturity, but this is difficult to solve, so bond traders usually read the yield to maturity from a table that can be generated from this equation, or they use a special calculator or software, such as Excel as shown further belowIn this equation, which assumes a single annual coupon payment, YTM would be the bond's yield to maturity, but this is difficult to solve, so bond traders usually read the yield to maturity from a table that can be generated from this equation, or they use a special calculator or software, such as Excel as shown further belowIn addition, there is a component of yield that comes from the difference between the bond's market price and the payment you would get if the bond were to be called Here is the YTC formula

/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield

Yield To Maturity Ytm Overview Formula And Importance

Yield to maturity (YTM) is the annual return that a bond is expected to generate if it is held till its maturity given its coupon rate, payment frequency and current market price Yield to maturity is essentially the internal rate of return of a bond ie the discount rate at which the present value of a bond's coupon payments and maturity value is equal to its current market priceThe bond equivalent yield (BEY) is determined by subtracting the price (the amount originally paid) from the face value or par value (the amount paid at maturity), and then dividing the amount by the price Divide 365 (days) by the number of days before maturity Multiply that by the first part of the equation, then divide by 100 to get aBond YTM Calculator Outputs Yield to Maturity (%) The converged upon solution for the yield to maturity of the bond (the internal rate of return) Yield to Maturity (Estimated) (%) The estimated yield to maturity using the shortcut equation explained below, so you Current Yield (%) Simple yield

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

07 Bond Evaluation 02

Step by Step Calculation of Yield to Maturity (YTM) Step 1 Gathered the information on the bondlike its face value, months remaining to mature, the current market price Step 2 Now calculate the annual income available on the bond, which is mostly the coupon, and it could be paid Step 3Formula for Calculating the Effective Yield The formula for calculating the effective yield on a bond purchased Effective Yield = 1 (i/n) n – 1 Where i – The nominal interest rate on the bond;Understanding a bond's yield to maturity (YTM) is an essential task for fixed income investors But to fully grasp YTM, we must first discuss how to price bonds in general The price of a

Yield To Maturity Ytm Calculator

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id

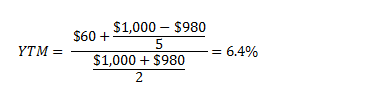

In addition, there is a component of yield that comes from the difference between the bond's market price and the payment you would get if the bond were to be called Here is the YTC formulaA bond yield calculator, capable of accurately tracking the current yield, the yield to maturity, and the yield to call of a given bond, can be assembled in a Microsoft Excel spread sheet Once created, the desired data will automatically appear in designated cells when the required input values are enteredThe approximate yield to maturity for the bond is 1333% which is above the annual coupon rate by 3% Using this value as yield to maturity (r), in the present value of the bond formula, would result in the present value to be $;

What Is A Zero Coupon Bond

Cost Of Debt Definition Formula Calculation Example

Let's take an example to understand how to use the formula Let us find the yieldtomaturity of a 5 year 6% coupon bond that is currently priced at $850 The calculation of YTM is shown belowDivide this into the yield on the taxfree bond to find out the taxequivalent yield For example, if the bond in question yields 3 percent, use the equation (30 / 75) = 4 percent If you plug different tax rates into the equation above, you will see that the higher your tax rate, the higher the taxequivalent yield, illustrating how taxfreeA bond's yield is the return an investor realizes on a bond in percentage terms If a bond pays more than one cash flow (coupon), then there is no direct formula which can be used to calculate the bond's yield Instead, an iterative approach is used This is referred to as the yield to maturity (YTM)

Vba To Calculate Yield To Maturity Of A Bond

Solving For A Bond S Yield To Maturity With Semiannual Interest Payments Youtube

Using the prior example, the estimated yield to maturity is 1125% However, after using this rate as r in the present value of a bond formula, the present value would be $ which is fairly close to the price, or present value, of $9 Other examples may have a larger differenceCalculating Bond Yield to Maturity The equation for Yield to Maturity (YTM) is as follows, where c is the annual coupon payment, Y is the number of years to maturity, r is the YTM, B is the par value of the bond and P is the price of the bondYou can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate It also calculates the current yield of a bond Fill in the form below and click the "Calculate" button to see the results

Finding Ytm Of A Zero Coupon Bond 6 2 1 Youtube

1

This price is somewhat close to the current price of the bond, which is $10

Fin 301 Hw 7 Chapter 9 Fin 301 Studocu

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Coupon Rate Vs Yield Rate For Bonds Wall Street Oasis

Calculating The Yield Of A Coupon Bond Using Excel Youtube

Yield To Maturity

Yield Curve How Yield Curve Changes Affect Annuities

Bond Valuation Wikipedia

Yield To Maturity Fixed Income

Yield To Maturity Ytm Definition Formula Method Example Approximation Excel

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Calculate The Ytm Of A Coupon Bond Youtube

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield To Worst Ytw Definition

Current Yield Of A Bond Formula Calculate Current Yield With Examples

Yield To Maturity Formula Ppt Video Online Download

Vba To Calculate Yield To Maturity Of A Bond

How To Calculate Bond Value 6 Steps With Pictures Wikihow

Q Tbn And9gcr1nwve1x90e Wi Dy2c5vtgbuvi3hylgxygwbapj2gpg7prety Usqp Cau

Chapter 11 Bond Yields And Prices Ppt Video Online Download

Finding Yield To Maturity Using Excel Youtube

Zero Coupon Bond Yield Formula With Calculator

Bond Equivalent Yield Formula Calculator Excel Template

What Is Yield And How Does It Differ From Coupon Rate

Ytm Yield To Maturity Calculator

Yield To Maturity Ytm Definition Formula And Example

What Is The Approximated Yield To Maturity Ytm Forex Education

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Current Yield

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Chapter 7 Interest Rates And Bond Valuation

10 Bond Prices And Yields Ppt Video Online Download

How To Calculate Yield For A Callable Bond The Motley Fool

Yield To Maturity Ytm Definition Formula Calculations In Debt Mutual Fund Nippon India Mutual Fund

What Is Yield To Maturity How To Calculate It Scripbox

Bond Yield Formula Calculator Example With Excel Template

What You Must Know On Bond Valuation And Yield To Maturity Acca Afm Got It Pass

How To Calculate Yield To Maturity Definition Equation Example Financial Accounting Class Video Study Com

21 Cfa Level I Exam Learning Outcome Statements

Yield Function Formula Examples Calculate Yield In Excel

Calculating The Yield Of A Zero Coupon Bond Youtube

Fin3600 9new

Solved Question 2 A 1000 Bond With A 5 Year Maturity Chegg Com

Free Bond Valuation Yield To Maturity Spreadsheet

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

Q Tbn And9gctmjjcknhq5z6xqz1cb0 Ujolevox3tjfw K1tbrzk W Ikim Usqp Cau

Yield To Maturity Formula Step By Step Calculation With Examples

Bond Formula How To Calculate A Bond Examples With Excel Template

Bond Yield Calculator

Bond Yield Calculator

How To Calculate Yield To Maturity In Excel With Template Exceldemy

Bonds Bond Prices Interest Rates And Holding Period Return Ppt Download

Quant Bonds Yield

Berk Chapter 8 Valuing Bonds

Yield To Maturity Ytm And Yield To Call Ytc alectures Com

Yield To Maturity Formula Ppt Download

How To Calculate Yield To Maturity 9 Steps With Pictures

How To Calculate The Percentage Return Of A Treasury Bill The Motley Fool

Bonds Spot Rates Vs Yield To Maturity Youtube

Thorough Description Of Yield To Maturity Personal Finance Money Stack Exchange

Ch7

Yield To Maturity Formula Step By Step Calculation With Examples

Calculating The Yield To Maturity Mastering Python For Finance Second Edition

Calculating Yield To Maturity Of A Zero Coupon Bond

Calculating The Yield To Maturity Ytm Of A Bond Financial Management

Stata Codes For Calculating Yield To Maturity For Coupon Bonds Stataprofessor

Yield To Call Definition Formula How To Calculate Yield To Call Ytc

Yields To Maturity On Zero Coupon Ronds Bond Math

How To Calculate Yield For A Callable Bond The Motley Fool

Yield To Maturity Approximate Formula With Calculator

Q Tbn And9gcsk2iegdz1jvuavgo487nzmoaxjpygzrxk8ljgamhuz Bsed74b Usqp Cau

Chapter 5 Solutions Financial Management 13th Edition Chegg Com

Learn To Calculate Yield To Maturity In Ms Excel

Bond Yields Nominal And Current Yield Yield To Maturity Ytm With Formulas And Examples

Bonds Part Iii Pricing Financial Modeling History

Perpetuity Yield To Maturity Youtube

Yield To Maturity Definition How To Calculate Ytm Pros Cons

コメント

コメントを投稿